Apple Card has been around for a few years now and, with it, Daily Cash. Up until now, you’ve only had one place to house all of that cash back: the Apple Cash Card.

It appears that Apple has decided to give everyone another option and has announced that it is launching a new savings account exclusively for Apple Card users. Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, says that its new savings account is another tool for its users to “lead healthier financial lives.”

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future. Savings delivers even more value to users’ favorite Apple Card benefit — Daily Cash — while offering another easy-to-use tool designed to help users lead healthier financial lives,” reads a statement from Apple on the new launch.

But what exactly will it offer, and is it worth moving your savings into an Apple-branded vault? Here’s everything we know so far about the Apple Savings account.

What is the Apple Savings account?

The Apple Savings account is a new savings account that users with an Apple Card can choose to open. Apple is marketing it as a “high-yield” savings account that users can deposit their Daily Cash into in order to get more out of the rewards they earn with their Apple credit card.

In addition to automatically depositing earned Daily Cash into the account, users will also be able to deposit additional funds into the account directly from a linked bank account.

How much interest will the Apple Savings account earn?

Apple has not yet said exactly how much interest its upcoming savings account will earn for account holders. In its press release announcing the account, Apple has only said that it will be a “high-yield” savings account.

However, we do know that the new savings account is held by Goldman Sachs, Apple’s current partner with Apple Card. Goldman’s consumer-facing brand is Marcus and that does currently have a savings account with an interest rate of 2.35% APY.

So, we can likely expect the interest rate for Apple’s Savings account to equal or exceed that number.

What kinds of fees will the Apple Savings account charge?

Just like Apple Card, the company is trying to go the no-fee route with its new Apple Savings account.

There are many savings account products in the financial market that have monthly maintenance fees, a minimum monthly balance in order to avoid those fees, and a minimum initial deposit to earn a certain percentage rate. Apple, in comparison, says that its new Apple Savings account will have “no fees, no minimum deposits, and no minimum balance requirements.”

So, if you have found that your current savings account has been nickel and diming your money, Apple’s Savings account might be a good option for you.

Who can open an Apple Savings account?

At launch, Apple says that its new Apple Savings account will only be available for Apple Card customers. This means that, if you do not have the company’s credit card, you will not be able to sign up for the new savings account.

More specifically, Apple’s Savings account will only be available for Apple Card owners and co-owners of the credit card. This language seems to indicate that if you have co-owners of an Apple Card, each person will open their own separate Savings account rather than one joint Savings account.

Limiting the Savings account to Apple Card owners and co-owners also means that members of your Apple Card Family, like a child that may be an authorized user, will not be able to open an Apple Savings account.

How will I create and manage my Apple Savings account?

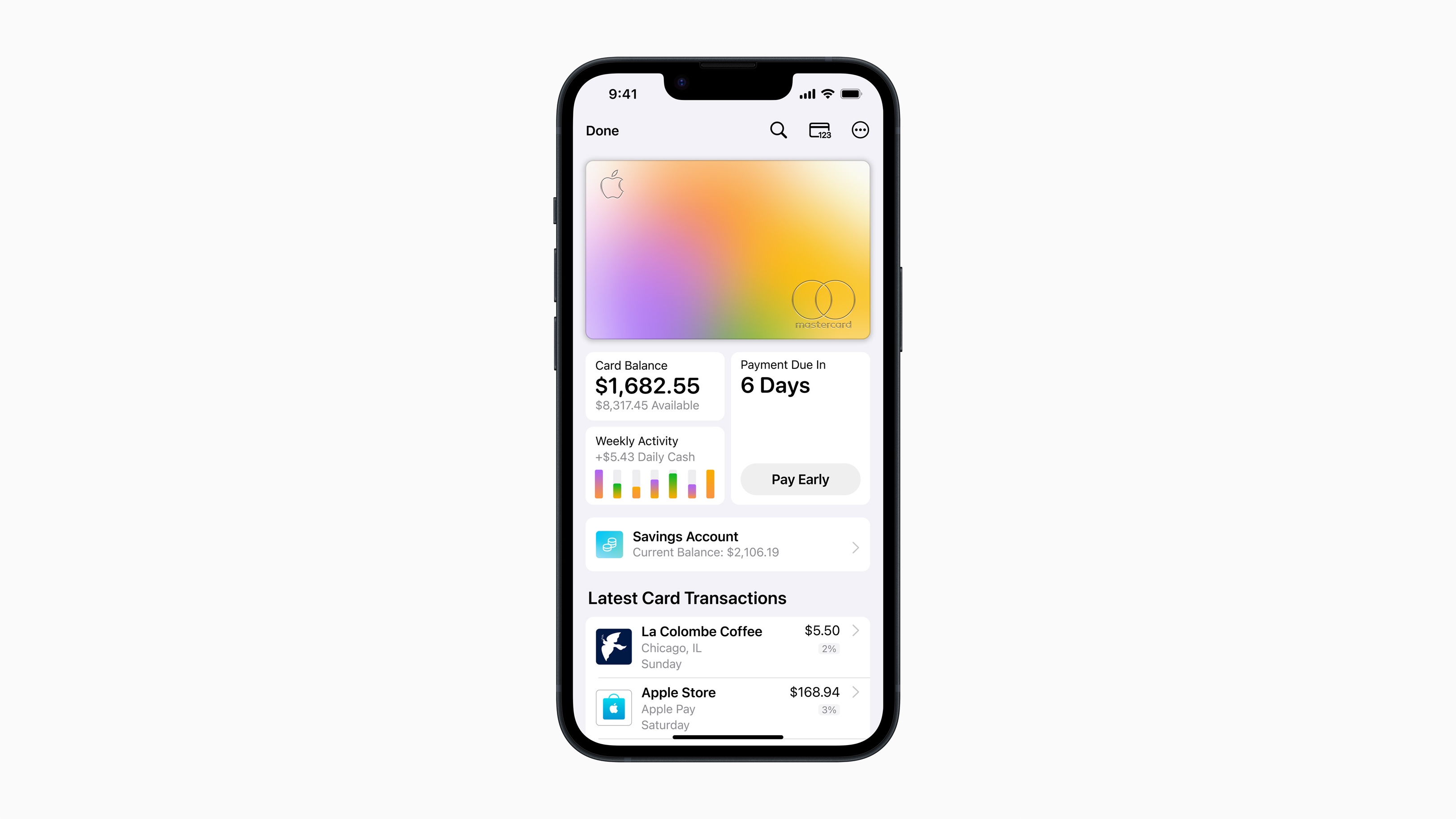

According to Apple, its new Savings account won’t be found directly in the Wallet app. Instead, it will be contained within the Apple Card experience in the Wallet app.

“Apple Card users will be able to easily set up and manage Savings directly in their Apple Card in Wallet,” Apple states.

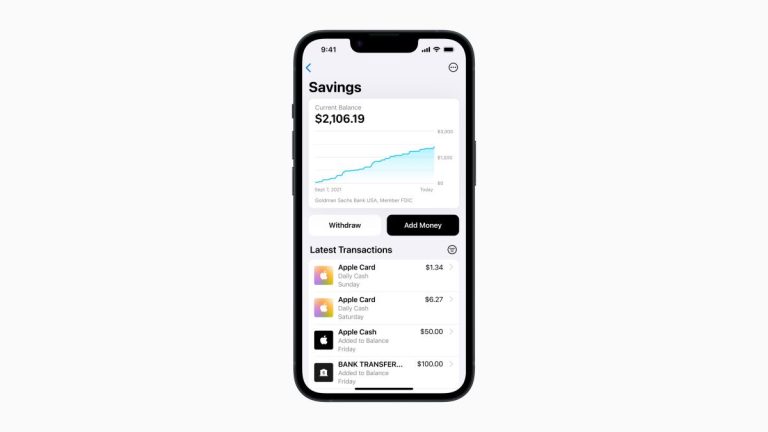

The company says that the Savings account will feature its own dashboard, showing users their balance and the amount of interest they have earned.

“Once set up, Apple Card users can watch their rewards grow in Wallet through an easy-to-use Savings dashboard, which shows their account balance and interest increased over time,” is how it’s described.

In the first developer beta for iOS 16.4 released in February 2023, code revealed that Apple is looking to store “routing and account numbers, current balance, earned interest, data management, funds available for withdrawal, and more” within the Wallet app to manage the Apple Savings account

How will I make deposits and withdrawals from my Apple Savings account?

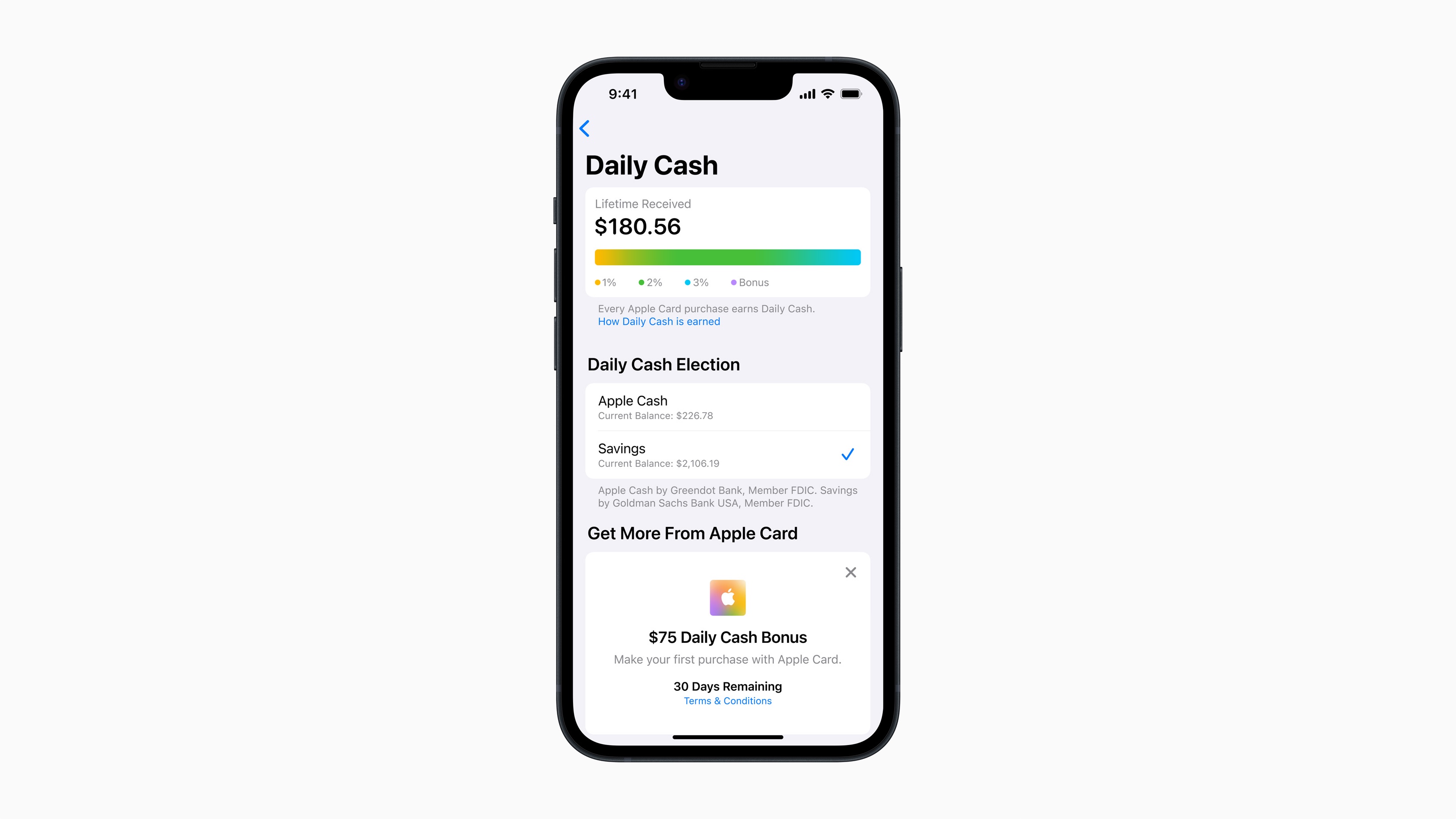

According to Apple, there are going to be two ways to make deposits into your Apple Savings account. The first allows account holders to have Daily Cash earned with their Apple Card automatically deposited into their new Savings account rather than their Apple Cash card:

“All future Daily Cash received will be automatically deposited into it, or they can choose to continue to have it added to an Apple Cash card in Wallet. Users can change their Daily Cash destination at any time.”

Account holders will also be able to make additional deposits into their Savings account from a linked bank account. The company also notes that you will be able to make withdrawals to your Apple Cash card or linked bank account:

“To expand Savings even further, users can also deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance. Users can also withdraw funds at any time by transferring them to a linked bank account or to their Apple Cash card, with no fees.”

In the first developer beta of iOS 16.4, Apple included language of how transfers will work. The beta includes copy that states that users can “transfer your Apple Cash balance to your savings account and start earning interest today” and “You can transfer up to [amount] from Apple Cash to your savings account in a single transaction and start earning interest today.”

When will the Apple Savings account launch?

Apple did not originally provide a release date when it announced the Savings account. The company just said that it would be available “in the coming months.”

However, in the release notes for iOS 16.1, the company revealed that the account will launch alongside the software update on Monday, October 24. That launch date, unfortunately, did not pan out as, when iOS 16.1 debuted to users, the savings account was missing from the release. Apple did not specify a new release date at that time.

At the beginning of December, Goldman Sachs updated its Apple Card Customer Agreement with language around the Apple Savings account. The company specifically said, “to enable new ways to use Daily Cash like the upcoming Savings account feature, we are updating the Daily Cash Program section of your Apple Card Customer Agreement.” That indicated that the Apple Savings account could launch soon, but that is still only speculation as there is still no communication directly from Apple as to when the account will debut.

Code within the first developer beta of iOS 16.4 references the Apple Savings account, indicating that the service could launch when the software update is rolled out to all users. It’s currently unknown when exactly that will be, but a recent report from Mark Gurman at Bloomberg indicated that it is likely to be in the spring along with Apple Pay Later, the company’s other upcoming financial service. That makes sense since Apple is set to host WWDC 23 in June.